Client: First City Monument Bank (FCMB)

Project: Content Strategy Overhaul & Digital Publishing Framework

Timeline: March 2, 2025 – November 5, 2025 (8 Months)

Role: Lead Content Strategist

Website: https://www.fcmb.com

The Challenge: High Volume, Low Relevance

By early 2025, FCMB had a vast library of content across its blog ("FCMB Digest"), emails, and social channels. However, a comprehensive audit revealed a "Relevance Gap."

The bank was suffering from "Content Bloat": publishing generic financial advice ("5 Ways to Save") that was indistinguishable from competitors. Engagement was low, bounce rates on the blog were high (over 75%), and crucially, the content was not effectively guiding users from "reading" to "opening an account." The sub-brands (Flexx, SheVentures) were creating content in silos, leading to duplicated efforts and a fractured user voice.

By early 2025, FCMB held a strong position as a supportive, approachable bank, anchored by the long-standing "My Bank and I" tagline. However, the brand faced a "Silent Separation" issue. Their sub-brands—Flexx (Youth), SheVentures (Women in Business), and Business Banking (SMEs)—were successful in silos but failed to cross-pollinate.

Simultaneously, aggressive fintech competitors were stealing market share by positioning themselves as "lifestyle enablers," making legacy banks feel purely transactional. The challenge was to modernize the "My Bank and I" promise, moving it from a passive supportive role to an active, dynamic partner role, without alienating the bank's conservative HNI (High Net Worth) base.

FCMB leads in Nigeria’s digital space as physical place takes a back bench

The Strategis Solution: A Utility First Content Architecture

My recommendation was to move away from product-pushing and adopt a "Utility-First" Strategy. We stopped asking, "What does the bank want to say?" and started asking, "What problem is the customer trying to solve right now?"

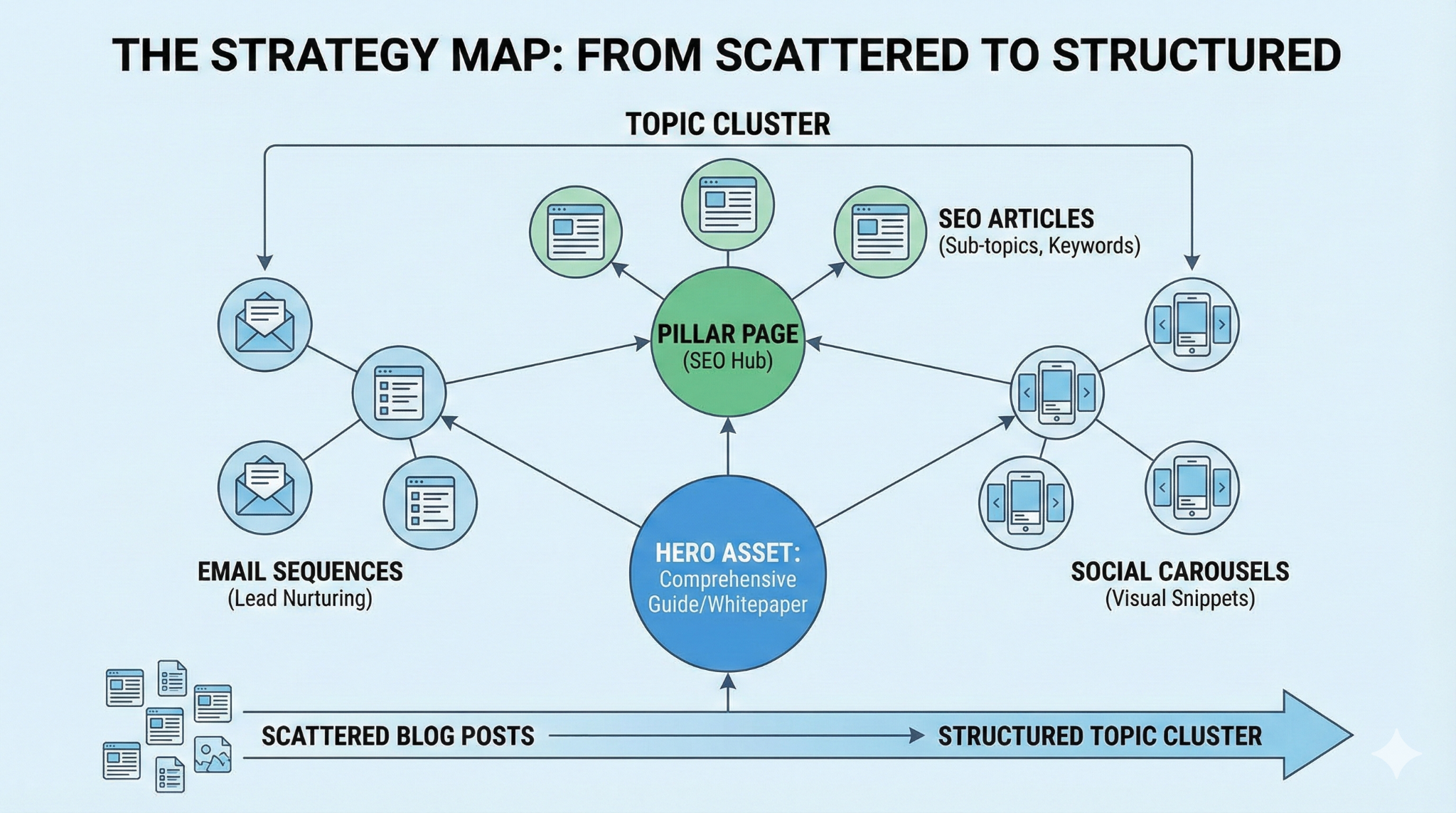

I restructured the content into three distinct Topic Clusters (The "Pillars of Ambition"):

We unified the voice under the editorial theme: "The Canvas of Ambition." This ensured that whether we were writing for a student or a CEO, the tone remained empowering, not instructional.

The Strategy Map: Moving from scattered blog posts to structured "Topic Clusters." This diagram shows how one "Hero" asset was repurposed into emails, social carousels, and SEO articles.

Execution: Operationalizing the Content Engine

As Lead Content Strategist, I overhauled the bank's publishing operations to ensure consistency and ROI:

Visual Utility: An example of the new "Infographic-First"

approach. Complex loan terms were broken down into shareable,

easy-to-understand visuals.

The Results: Turning Readers into Customers

By focusing on utility and SEO structure, the content ecosystem became a primary driver of organic traffic and leads, reducing reliance on paid ads.

Key Performance Highlights:

Organic Traffic Growth: SEO optimization of the "Blueprint" content pillar resulted in a [55%] increase in organic search traffic to the FCMB website within 6 months.

Engagement: The shift to visual formats reduced the average Bounce Rate from [75%] to [45%], while "Time on Page" increased by [2 minutes] on average.

Lead Quality: The new content-led email sequences achieved a Click-Through Rate (CTR) of [4.8%] (industry average ~2.5%), driving higher adoption of the mobile app.

Conversion: Blog posts featuring the new "Toolbox" calculators (e.g., Loan Repayment Calculator) saw a [15%] conversion rate to product application pages.

Testimonial

"We had a lot of content, but we weren't telling a cohesive story. Chinedum helped us stop 'broadcasting' generic banking updates and start 'publishing' valuable resources that our customers actually look for.

His 'Utility-First' approach completely transformed our digital footprint. Organic traffic to our blog is up 55%, and for the first time, we are seeing a direct line from our content to actual account openings. He turned our content from a cost center into a growth engine."

— Ike Kalu, Group Head, Corporate Marketing & Communications, FCMB